portability of estate tax exemption 2019

If your estate is larger than 114 million then the excess may be subject to the Federal. Pursuant to legislation passed in 2014 the Maryland estate tax exemption continues to increase as follows.

Irs Announces Higher Estate And Gift Tax Limits For 2020

Since transfers to spouses are free from estate tax the settling of the husbands estate will not use up any of his 11 million exemption and no federal estate tax filing is required.

. In addition the non-citizens exemption is only 60000 so the estate may owe. Foreseeing the inflation the TCJA has set to increase the exemption over time with the shift first made in. Unfortunately couples that include a non-citizen non-US.

Unless your taxable estate is worth more than 114 million your estate will not owe federal estate tax if you die in 2019. Preserving Estate Tax Portability for the Benefit of Your Heirs. For individuals passing away in 2017 the estate tax is the tax applicable to any amount in the decedents estate over the Federal estate tax exemption of 549 million per person.

Please note that these exemption amounts are for. Since Joan and Mark are married they are eligible for the portability rules. It sat at 114 million for 2019 1158 million for 2020 and it has now hit 117 million for 2021.

Thanks to the annual federal gift tax exclusion 15000 for 2018 and 2019 both you and your spouse can make annual gifts to a single recipient. With exemption levels being indexed for inflation the exemption amount has gone up still. In the 2010 Tax Act the concept of portability of the unused transfer tax exemption was first introduced in the tax law.

This is the amount a person can leave their heirs without paying federal estate taxes and which is annually indexed for inflation. Portability continues to greatly increase the power of this exemption for married couples who can now. That number was indexed for inflation and went up each year.

The Maryland estate tax exemption is not portable between spouses until it. The portability of unused estate tax exemption is allowed for persons dying on or after January 1 2011. Portability allows a surviving spouse the ability to transfer the deceased spouses unused exemption amount DSUEA for estate and gifts taxes to a surviving spouse so long as the Portability election is made on a timely filed federal estate tax return IRS Form 706.

The surviving spouse now has the entire 9 million of assets in her estate. The 2019 Federal estate tax exemption will be 114 million. Portability became available in 2011 when the exempt amount was 5 million.

The Internal Revenue Service IRS has announced the estate tax exemption and gift tax exemption amounts for 2019. However when one spouse dies the surviving spouse is encouraged to file a Federal Estate Tax return for reasons of portability. Though much has changed with regards to gift and estate tax planning since the Tax Cuts and Jobs Act TCJA was passed in 2017 one thing that was preserved was estate tax portability a helpful tax benefit that should be considered when crafting your estate plan.

If one spouse dies before another and doesnt use 100 of hisher estate tax exemption the surviving spouse can use the remaining exemption plus hisher own exemption when they die. This means that the exemption moved up to 1118 million per person for the years 2018 through 2025. The option of estate tax exemption portability can make a significant difference when it comes to taxation of an estate.

With portability any unused estate tax exemption of the first spouse to die can be carried over to and used by the surviving spouse for federal gift and estate tax purposes. The exemption is 11400000 for 2019 and is indexed for inflation. Under the 2010 Tax Act the unused estate tax exemption could be ported over to the surviving spouse.

The estate of a deceased non-citizen cannot elect to give the surviving citizen spouse any of the remaining estate tax exemption. Portability Federal Estate Tax Exemptions. Please note these laws being permanent means that they are not set.

Joan died in 2019 when the married filing jointly estate tax exemption was 22. Up to 25 cash back Federal Estate Tax Exemption -- 114 million. With the passage of the Tax Cuts and Jobs Act of 2017 its 1206 million per person for deaths in 2022.

Now assume that in 2021 Congress lowers the exclusion to 5 million keeping the. However the 2010 Tax Act sunset on December 31 2012. Resident may not be able to take advantage of estate tax portability.

The Estate Tax Portability Election. This is an increase from the 2018 exemption amount of 1118 million. It is recommended that individuals and couples with substantial assets create an estate plan with the help of an attorney to help them minimize their federal tax liability.

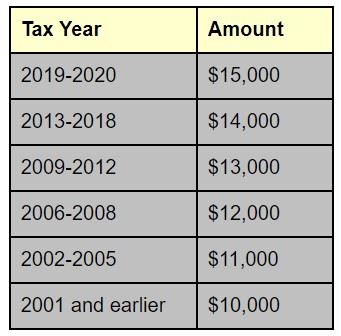

The tax exemption change works with the federal gift and estate tax where the TCJA act doubles the existing exemption from 5 million to 10 million. The 2017 tax law vastly increased the amount an estate can pass on tax-free the exemption doubled to 1118 million in 2018 from 549 million the prior tax year. 2018 -- 4000000 an increase of 1000000 from 2017 2019 and thereafter -- the Maryland exemption will match the federal basic exclusion amount.

Depending on the date of the deaths the total exemption amount may exceed 24 million. Many advisers may be. Note that with regard to state estate taxes currently only Hawaii offers portability at the state level and Maryland will begin offering portability of its state estate tax exemption at the beginning of 2019 for decedents who die on or after January 1 2019.

The Federal gift tax exemption will remain 15000 annually for the time being.

Word Tax With Clock On The Office Workplace Business Concept Getty Images Tax Deductions Capital Gains Tax Irs Taxes

Wsj Tax Guide 2019 Estate And Gift Taxes Wsj

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Recent Changes To Estate Tax Law What S New For 2019

It May Be Time To Start Worrying About The Estate Tax The New York Times

Vat In Spain Reverse Charge Inversion De Sujeto Pasivo

What Are The Estate And Gift Tax Limits For 2019 Lommen Abdo

Tackling Tax Issues If You Re An Estate Executor Ferrari Ottoboni Caputo Wunderling Llp

Tips Pajak Archives Laman 3 Dari 15 Flazztax

Historical Estate Tax Exemption Amounts And Tax Rates 2022

New York Estate Tax Everything You Need To Know Smartasset

Estate Tax Portability Preserving It For The Benefit Of Your Heirs

Tips Pajak Archives Laman 3 Dari 15 Flazztax

Planning For 2022 Tax Updates For A Happy New Year The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

Portability How It Works For Estate Tax Batson Nolan

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel